Australian Dollar Outlook: AUD/USD, AUD/JPY at Risk to Long Bets

AUSTRALIAN DOLLAR, AUD/USD, AUD/JPY, FED, IG CLIENT SENTIMENT - TALKING POINTS

- Australian Dollar extends selloff after the Fed versus USD and JPY

- Trader positioning hints more declines in AUD/USD and AUD/JPY

- Technical analysis favoring the downside scenario for the Aussie?

AUSTRALIAN DOLLAR FALLS AS US DOLLAR AND JAPANESE YEN GAIN AFTER THE FED

The sentiment-linked Australian Dollar succumbed to selling pressure against the haven-tied US Dollar and anti-risk Japanese Yen following the Fed’s interest rate decision in January. This has left AUD/USD and AUD/JPY at risk to prolonging their near-term declines which picked up pace on coronavirus fears. An uptick in net-long positioning is also contributing to bearish outlooks in these pairs which are discussed in this week’s session on IG Client Sentiment (IGCS) – see recording above.

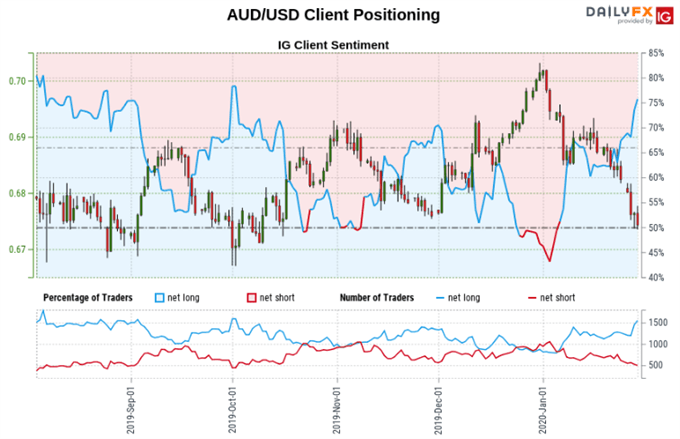

AUD/USD SENTIMENT OUTLOOK

According to the IGCS report from January 29, about 77.82 percent of traders are net long AUD/USD. This is up from around 45% earlier this month. Since then, the Australian Dollar has lost over 4.2% in value against the US Dollar. Those net long are roughly 17.02% and 33.99% higher compared to yesterday and with last week respectively.

We typically take a contrarian view to crowd sentiment, and the fact traders are netlong suggests that AUD/USD prices may continue falling. The combination of current sentiment and recent changes gives us a stronger bearish contrarian trading bias. From a psychological perspective, this may speak to a greater share of traders attempting to pick the bottom in the Aussie.

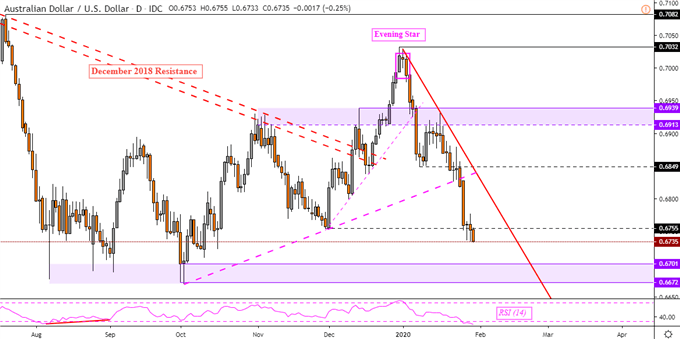

TECHNICAL ANALYSIS

On the daily chart, AUD/USD has extended its selloff from the December peak following bearish technical signals – as expected. Prices are looking to clear the December low heading towards the trough in 2019. The latter is a psychological barrier between 0.6672 to 0.6701. Maintaining the near-term downtrend is a descending line from earlier this month.

AUD/USD DAILY CHART

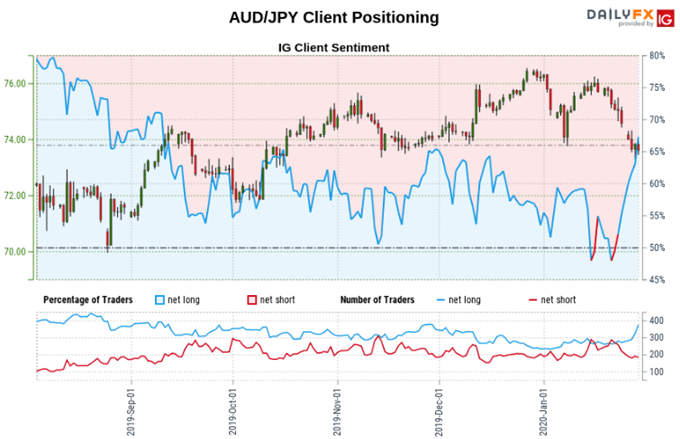

AUD/JPY SENTIMENT OUTLOOK

According to IGCS, about 65.99% of AUD/JPY traders are net long at the time of this writing. This represents an uptick from earlier this month when just below 50% of investors were biased to the upside. Since then, the Australian Dollar has declined about 3.75% against the Japanese Yen. The number of traders betting to the upside are about 12.72% and 36.36% higher versus yesterday and last week respectively.

We typically take a contrarian view to crowd sentiment.Since traders are net-long, it suggests AUD/JPY prices may continue descending. The combination of current sentiment and recent changes offers a stronger AUD/JPY-bearish contrarian trading bias. That would likely speak to a greater share of traders attempting to pick the turning point in the current trend.

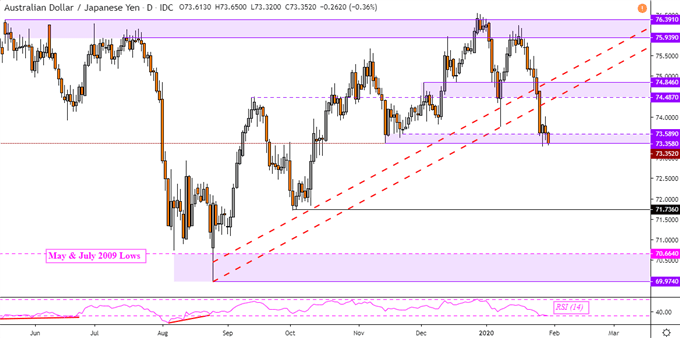

TECHNICAL ANALYSIS

On a daily chart, AUD/JPY has taken out a rising support channel from August 2019. Prices have since seen downside follow-through. The pair is testing November lows which makes for a support range between 73.35 to 73.58. Taking this area out exposes lows from October as AUD/JPY attempts to reverse the uptrend from August to late-December.

AUD/JPY DAILY CHART

Comments

Post a Comment