EUR/USD Rate Struggles Ahead of EU Meeting on European Recovery Fund

EUR/USD RATE TALKING POINTS

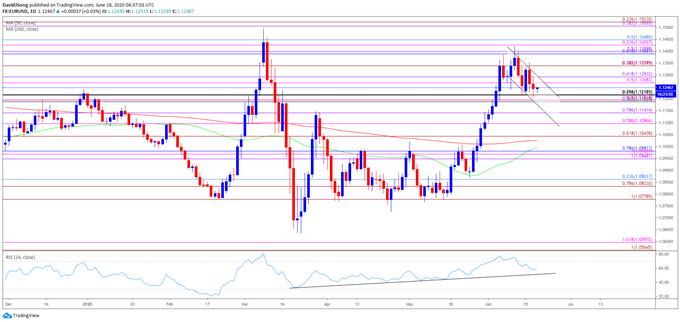

EUR/USDstruggles to hold its ground following the failed attempt to test the March high (1.1495), and the exchange rate may continue to give back the advance from the May low (1.0767) as the Relative Strength Index (RSI) pulls back from overbought territory.

EUR/USD RATE STRUGGLES AHEAD OF EU MEETING ON EUROPEAN RECOVERY FUND

EUR/USD dips to a freshly weekly low (1.1207) ahead of the European Council meeting on June 19, with the agenda largely focused on “establishing a recovery fund to respond to the COVID-19 crisis.”

It remains to be seen if an agreement will be reached as the European Central Bank (ECB) expands the Pandemic Emergency Purchase Programme (PEPP) in June by EUR 600B to EUR 1.350 trillion, and European Union (EU) officials may merely attempt to buy time as the Governing Council “remains fully committed to doing everything necessary within its mandate to support all citizens of the euro area through this extremely challenging time.”

Recent remarks from ECB board member Fabio Panetta suggest the central bank will utilize its balance sheet throughout 2020 as he expects “a prolonged period of very accommodative monetary policy,” with the official going onto say the central bank is “ready to take all the necessary measures to reach our inflation objective.”

At the same time, Mr. Panetta argues that the proposed EUR 750B Recovery Fund should be deployed “no later than early 2021” as the ECB rules out a V-shape recovery, and it seems as though President Christine Lagarde and Co. will retain a dovish forward guidance in the second half of the year even though “euro area activity is expected to rebound in the third quarter as the containment measures are eased further.”

Nevertheless, the Governing Council may move to the sidelines following the decision to expand the PPEP, and the reluctance to implement lower interest rates may keep EUR/USD afloat as the central bank appears to be on track to retain the current policy at the next meeting on July 16.

However, the failed attempt to test the March high (1.1495) may generate a near-term correction in EUR/USD, and the exchange rate may continue to give back the advance from the May low (1.0767) as the Relative Strength Index (RSI) pulls back from overbought territory.

EUR/USD RATE DAILY CHART

- Keep in mind, the monthly opening range was a key dynamic for EUR/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 1, with the high for November occurring during the first full week of the month, while the low for December happened on the first day of the month.

- The opening range for 2020 showed a similar scenario as EUR/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first trading day of the month.

- However, the opening range for March was less relevant amid the pickup in volatility, with the pullback from the yearly high (1.1495) producing a break of the February low (1.0778) as the exchange rate slipped to a fresh 2020 low (1.0636).

- Nevertheless, EUR/USD appeared to be on track to test the March high (1.1495) after breaking out of the April range, but the exchange rate struggles to retain the advance from the start of the month amid the failed attempt to close above the Fibonacci overlap around 1.1390 (61.8% retracement) to 1.1400 (50% expansion).

- It remains to be seen if a bull flag formation will pan out over the coming days as the Relative Strength Index (RSI) continues to track the upward trend from earlier this year, but a break of trendline support would negate the scope for a continuation pattern as it highlights a potential shift in market behavior.

- Need a break/close below the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) to bring the 1.1140 (78.6% expansion) region on the radar, with the next area of interest coming in around the 1.1100 (7.86% expansion) handle.

Comments

Post a Comment